Crypto was designed to be borderless. Tax systems were not.

For years, that mismatch created confusion — and in some cases, false comfort. Many investors assumed crypto activity was difficult for tax authorities to see, especially when exchanges, wallets, and jurisdictions didn’t neatly align.

That assumption is now outdated.

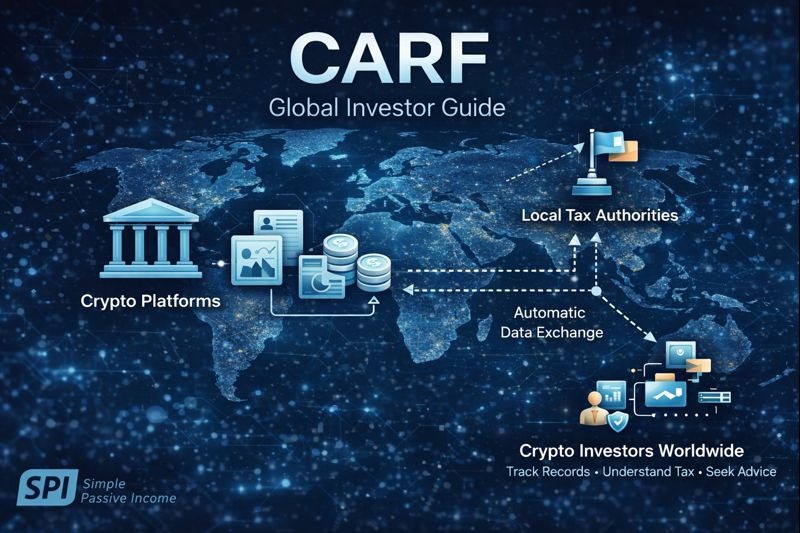

The Crypto Asset Reporting Framework (CARF) is a global standard that changes how crypto activity is reported, shared, and verified across borders. This article explains who CARF affects, what it does, when and where it applies, and—most importantly—how crypto investors worldwide should respond.

WHO does the Crypto Asset Reporting Framework affect?

CARF primarily targets Crypto-Asset Service Providers (CASPs), not individual investors. These include:

- Centralised crypto exchanges

- Custodial wallet providers

- Crypto brokers and trading platforms

- Platforms facilitating buying, selling, or swapping crypto

- Some payment processors and on/off-ramps

However, while platforms carry the reporting obligation, investors remain responsible for their own tax compliance. If you use a reporting platform, CARF indirectly affects you.

Plain English: Platforms report. Governments share. Investors must explain.

WHAT is CARF and what does it actually do?

CARF is an international tax reporting framework developed by the OECD (Organisation for Economic Co-operation and Development) .

The framework gives tax authorities consistent, third-party verified information about crypto transactions —especially those that cross borders.

Under CARF, in-scope crypto platforms must:

- Identify users (including tax residency)

- Track certain crypto transactions

- Report aggregated transaction data to local tax authorities

- Participate in automatic information exchange between countries

Importantly, CARF does not create new taxes. Instead, it strengthens enforcement of existing tax laws by improving visibility.

WHEN does CARF apply?

In practice, CARF is being implemented in phases. As a result, most participating countries are targeting rollout windows between 2025 and 2027.

The exact start date depends on:

- Local legislation

- Regulatory readiness

- Platform implementation timelines

In practice, many platforms will begin collecting enhanced user information before formal reporting deadlines. This is similar to how bank reporting evolved under the Common Reporting Standard (CRS).

Key takeaway: CARF is not “one big switch.” It is a gradual tightening of reporting standards worldwide.

WHERE does CARF apply?

CARF is a multilateral framework. It applies in countries that adopt the standard and agree to exchange information.

Jurisdictions actively working toward CARF alignment include:

- European Union member states

- United Kingdom

- Australia

- Canada

- South Africa

- Many OECD and G20 countries

Crucially, CARF focuses on tax residency rather than platform location. Because of this, using an offshore exchange does not automatically remove tax obligations.

This mirrors existing global standards like: CRS (Common Reporting Standard) .

HOW does CARF work across borders?

CARF enables automatic exchange of crypto transaction data between participating tax authorities.

A simplified example:

- You live in Country A

- You trade on an exchange based in Country B

- The exchange reports your activity to Country B’s tax authority

- That data is shared with Country A (your tax residence)

This is not theoretical. In fact, it is the same mechanism already used for international bank accounts.

Important: CARF does not track private wallets directly. It connects reporting points where crypto touches regulated platforms.

WHAT should crypto investors worldwide do now?

CARF does not require panic. It requires preparation.

1) Confirm your tax residency

Tax obligations are usually based on where you are tax resident, not where your exchange is registered. This matters more under CARF.

2) Track all crypto activity properly

Relying on bank withdrawals alone is no longer sufficient. Track:

- Trades

- Swaps

- Staking and rewards

- Transfers between wallets

Many investors use dedicated crypto tax software to consolidate records, such as: Koinly, Recap, or CoinTracking.

3) Understand how your country classifies crypto

Most countries distinguish between:

- Long-term investing (often capital gains)

- Frequent trading (often income)

- Rewards, mining, and staking (often income)

CARF does not change these rules. It increases the likelihood that inconsistencies will be noticed.

4) Separate investing and trading activity

Mixing long-term holdings and active trading in the same wallet creates unnecessary complexity. Clear separation makes explanations easier if questions arise.

5) Get advice if your situation is complex

If you traded heavily, used DeFi extensively, or have multi-year activity, professional advice can save significant time and stress.

Stay Ahead of Global Crypto Rules

CARF won’t be the last change.

Get clear, no-hype updates on crypto tax, compliance, and passive income — explained simply.

How this connects to South Africa (and other countries)

This global guide complements our country-specific breakdowns, including: Crypto tax South Africa: CARF 2026 Playbook .

While implementation details differ by country, the core message is universal:

Crypto is no longer operating outside the global reporting system. It is being integrated into it.

CARF Compared: South Africa vs Global Implementation

While the Crypto Asset Reporting Framework (CARF) is a global standard, how it is implemented and enforced differs by country. The table below highlights the key differences between South Africa’s CARF approach and how CARF works more broadly worldwide.

| Category | South Africa (SARS) | Global CARF (OECD Countries) |

|---|---|---|

| Regulator / Authority | South African Revenue Service (SARS) | Local tax authorities under OECD coordination |

| Effective period | Implementation from 2026 (with reporting ramp-up) | Rolling implementation (2025–2027 depending on country) |

| Who reports | Crypto Asset Service Providers operating in or servicing SA residents | Crypto platforms operating in CARF-participating jurisdictions |

| What is reported | User identification, transaction data, disposals, and values | Similar data sets, standardised across countries |

| Cross-border sharing | Yes — via international exchange agreements | Yes — automatic exchange between participating countries |

| Tax rules | Based on SA income tax and CGT rules | Based on each country’s local tax law |

| Main impact on investors | Higher verification by SARS; fewer disclosure loopholes | Global visibility of crypto activity tied to tax residency |

The key takeaway is that CARF does not standardise tax rates. It standardises information visibility. What you owe still depends on your country’s tax rules — but hiding activity becomes far more difficult.

Frequently Asked Questions About the Crypto Asset Reporting Framework

Is CARF only for South Africa?

No. CARF is a global framework developed by the OECD and is being implemented by many countries worldwide. South Africa is one participant, but the framework applies across multiple jurisdictions.

Does CARF mean crypto is now taxed everywhere?

No. Crypto taxation already existed in most countries before CARF. CARF improves reporting and information sharing; it does not create new taxes.

Will CARF track my private wallet?

CARF does not directly monitor private wallets. It focuses on reporting by regulated platforms where crypto is bought, sold, swapped, or custodied.

What if I use offshore exchanges?

Offshore exchanges located in CARF-participating countries may still report activity. Tax obligations are generally based on your tax residency, not where the exchange is located.

Does CARF apply to DeFi?

Pure decentralised protocols are harder to report on directly, but CARF focuses on entry and exit points such as exchanges, bridges, and on/off-ramps.

What should global crypto investors do now?

Investors should confirm their tax residency, keep accurate records, understand local crypto tax rules, and seek professional advice if their activity is complex.

Final SPI take

Ultimately, CARF is not an attack on crypto. Instead, it signals that crypto has matured into a globally recognised asset class.

Every major asset class follows the same path: ignored → misunderstood → regulated → normalised.

CARF marks the transition into normalisation. Investors who adapt early gain clarity. Those who ignore it inherit stress later.

Disclaimer: This article is for educational purposes only and does not constitute tax advice. Tax rules vary by jurisdiction.

Leave a Reply